Key insights to reestablish solid and forward-looking luxury brands

Introduction

Several components of the luxury industry are changing, opening a new road that executives must identify and undertake to stay competitive.

In 2024, the sector’s expansion has interrupted for the first time in five years (excluding 2020). Various macroeconomic events, from the crisis in China to Trump’s tariffs, led to a negative shock in demand. Meanwhile, customers’ changing interests and engagement with products are adding complexity to the industry.

However, as highlighted by McKinsey, luxury woes are partially self-inflicted and are closely related to the strategic approach adopted during the growth period.

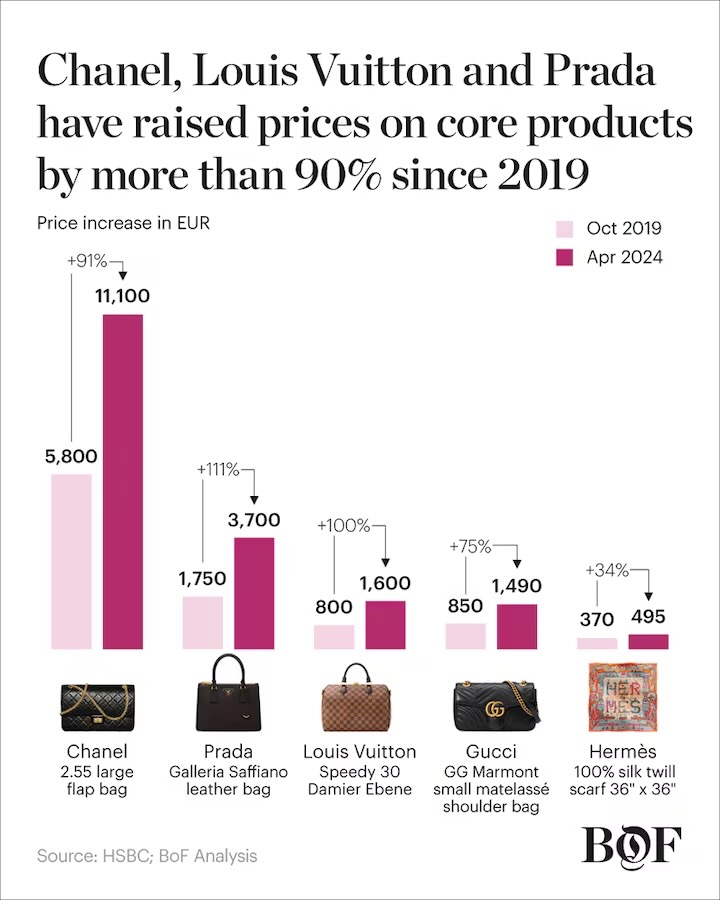

The brands’ overexposure damaged the intrinsic exclusivity of the industry, and the increase in prices was, in most cases, the only measure adopted to address higher demand.

As a result, annual global growth is expected to be slower until 2027, reaching between 1 and 3 per cent. So, now more than ever, it is crucial to adopt a long-term vision and re-establish the hedonic values of luxury, eventually transforming the downturn into an opportunity to realign.

“The world produces waves. Surf or drawn. You decide.”

Virgil Abloh, 2017

Key Insights

Digital Strategy

In a world where everyone is overstimulated by continuous notifications and fast videos, luxury has the role to make people dream, and dreams, by definition, require time.

Hermès, whose market value recently surpassed LVMH, does not have a TikTok account, and its most famous bag, the Birkin, requires years of waiting to be bought. One of the few growing Kering houses, Bottega Veneta, is using social media absence as a strategy, and The Row is going on a similar road.

Though organically different, these brands are the tangible proof that digital strategies in the luxury sector should be reviewed to find a more balanced approach, thus enhancing offline experiences rather than just online ones.

Travel and Experiences

In the aftermath of the pandemic, the trade-off between products and experiences has become more and more evident, transforming experiential luxury in a central strategic pivot.

“If I have to spend £10k, I’ll do it on wellness or travel, no longer fashion — without hesitation.”

HNWI, UK

Customers have “over-consumed” goods since COVID and are now shifting their preferences towards money-can’t-buy experiences.

Cultural immersions, sports, fine dining, hospitality, wellness: luxury groups have ample space to diversify their portfolio and satisfy the needs of future (and current) customers.

Product Excellence

As the CEO of Prada Group, Andrea Guerra states, in many cases, luxury has been spoilt by leather goods. Easier to sell than ready-to-wear, they were the main victim of price increases. Relying on the price inelasticity of super wealthy clients, firms forgot to match what, in some cases, has been a hyperinflation, to a greater value added.

Consequently, brands lost both the most spending and the aspirational customers, who started to think twice before buying ‘not so luxury’ goods.

If, according to the President of Prada Group Bertelli, reducing the prices of luxury items is not the solution, it is crucial to bring back those values that made fashion flourish a few years ago. Those values of credibility, genuine craftsmanship and deeper cultural significance, in two words: product excellence.

Although this may seem reductive, many brands lose sight of what made them successful, that is, the goods they sell. Those are, indeed, the result of a creative and artisanal process that buyers want to perceive, and that cannot be invented, especially with younger generations.

Prada and Miu Miu, for example, are now harvesting the seeds of their main creative director, Miuccia Prada, who has introduced a minimal yet loud speaking style, revolutionising the approach to fashion like Coco Chanel or Yves Saint Laurent did in the last century.

Lamborghini is playing on the same innovation ground, constantly evolving their styles and retiring one model every ten years or so.

Even if in a more conservative way, Hermès leverages timeless exclusivity and unquestionable quality to affirm itself as the main symbol of luxury.

Better production practices

he environment is a key issue for young generations, and it is mirrored in their purchase decisions. According to Vogue Business, 49% of Gen Z consumers prioritise sustainability in purchase decisions, and this trend will likely increase with Gen Alpha, as climate change continues to be felt.

Gen Z customers are going to drive 25 to 30 per cent of luxury purchases by 2030 (Bain), hence adopting better production practices is fundamental to building solid relationships with future clients (other than contributing to save our planet).

In this sense, initiatives like Prada Re-Nylon or Stella McCartney’s vegan products are great models to follow for a more sustainable approach to fashion.

Cultural relevance

“Culture is also a business factor […]. Companies must be responsible, becoming an example.”

Diego Della Valle, Vogue

Kantar’s research has proven that brands with high cultural relevance grow six times more than brands with low cultural relevance.

For luxury brands, a great way to acquire it is towards arts and sports. Miu Miu’s Literary Club, Prada’s Luna Rossa sailing team, Fondazione Prada, the new sound Atelier by Valentino in New York exemplify how brands can use culture and lifestyle to forge deep, emotional bonds with consumers.

By Camilla Stasia Padula

Sources:

https://www.cnbc.com/2024/10/31/how-herms-is-bucking-the-global-luxury-slowdown.html

https://www.kering.com/it/news/first-quarter-2025-revenue

https://www.mckinsey.com/industries/retail/our-insights/state-of-luxury#

https://www.voguebusiness.com/story/consumers/how-can-brands-capture-the-loyalty-of-gen-z

https://www.bain.com/insights/long-live-luxury-converge-to-expand-through-turbulence

Images

Cover: Grand Hotel Tremezzo (foto via Instagram @taabaclub)

Digital strategy: Hermès Birkin, Harpes Bazar

Product Excellence: Business of Fashion

Travel and Experience: Langosteria Paraggi

Better production practices: Vogue business

Cultural relevance: Miu Miu literary club 2025 (Vogue)